Understanding CFD Forex Trading: A Comprehensive Guide

Contract for Difference (CFD) trading in the Forex market has gained immense popularity among traders seeking to capitalize on price fluctuations without actually owning the underlying assets. By utilizing CFDs, traders can speculate on the rising or falling prices of currency pairs, making it an attractive option for both beginners and seasoned traders alike. In this guide, we will delve into the intricacies of CFD Forex trading, examining its benefits, risks, and effective strategies to enhance trading performance. For those looking for a reputable trading platform, consider checking out cfd forex trading Trading Broker SA.

What is CFD Forex Trading?

CFD Forex trading refers to the practice of trading contracts that enable individuals to speculate on the price movements of foreign exchange currencies without owning the actual currency. When you enter a CFD trade, you are essentially agreeing to exchange the difference in value of the currency pair from the time the contract is opened to when it is closed. This form of trading allows for both long and short positions, providing traders with opportunities to profit regardless of market direction.

How Does CFD Forex Trading Work?

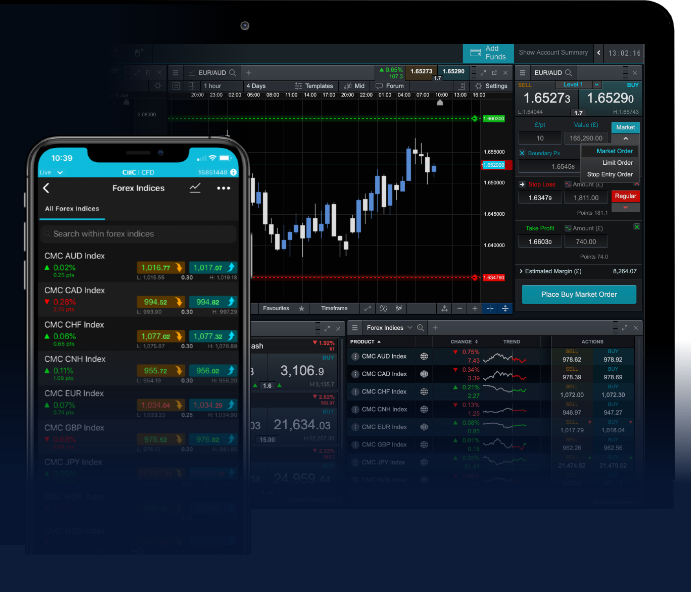

When a trader engages in CFD trading, they do so through a broker. The broker provides the platform for trading and executes orders on behalf of the trader. Here’s a step-by-step breakdown of how CFD Forex trading works:

- Open a Trading Account: Choose a reputable broker and open a trading account. This often involves verifying your identity and funding your account.

- Select a Currency Pair: Choose the currency pair you wish to trade, such as EUR/USD or GBP/JPY.

- Determine Your Position: Decide whether you believe the currency pair will rise or fall. If you expect the price to rise, you open a long position; if you expect it to fall, you open a short position.

- Trade Execution: Execute your trade by entering the necessary details into the trading platform. The broker will facilitate the transaction, and you’ll either gain or lose money depending on market movements.

- Close Your Position: When you want to realize your profits or losses, you close your position, and the difference in price will be settled in cash.

Benefits of CFD Forex Trading

CFD Forex trading offers numerous advantages that appeal to traders worldwide. Some of the key benefits include:

- Leverage: CFDs allow traders to use leverage, enabling them to control a larger position with a smaller amount of capital. This magnifies potential profits, although it can also amplify losses.

- Diverse Opportunities: Traders can access a wide range of currency pairs, including major, minor, and exotic currencies, which provides diverse trading opportunities.

- Short Selling: CFD trading enables short selling, allowing traders to profit from falling markets.

- No Ownership of Underlying Assets: Since you are trading contracts and not owning the actual currency, it eliminates the need for currency exchange or conversions.

- Flexible Trading Hours: The Forex market operates 24 hours a day, allowing traders to enter or exit positions at any suitable time.

Risks Involved in CFD Forex Trading

While CFD Forex trading presents many opportunities, it is essential for traders to be aware of the risks involved. Some of the primary risks include:

- Market Volatility: The Forex market can be highly volatile, leading to rapid price movements. This volatility can result in significant losses, especially when trading with leverage.

- Leverage Risks: While leverage can enhance profits, it can also lead to greater losses if the market moves against your position.

- Counterparty Risk: Since CFDs are contracts with a broker, there is a risk that the broker may default on the contract, leading to financial losses.

- Emotional Trading: The intense nature of the Forex market can lead to emotional decision-making, which can negatively impact trading performance.

Effective Strategies for CFD Forex Trading

To maximize success in CFD Forex trading, traders should implement effective strategies. Here are some popular strategies to consider:

- Technical Analysis: Utilize technical analysis tools such as charts, indicators, and patterns to identify potential entry and exit points.

- Fundamental Analysis: Stay informed about economic news and events that may impact currency prices, such as interest rate changes and geopolitical developments.

- Risk Management: Implement strict risk management practices, including setting stop-loss orders to limit potential losses, and only risking a small percentage of your capital on each trade.

- Trades with a Plan: Always have a trading plan that outlines your goals, risk tolerance, and strategies to guide your trading decisions.

- Practice with a Demo Account: Before trading with real money, practice your strategies on a demo account to gain experience and build confidence.

Conclusion

CFD Forex trading presents an exciting opportunity for traders to engage with the financial markets, offering potential profits through speculation on currency price movements. However, it is crucial for traders to understand the inherent risks and develop effective trading strategies to navigate this complex market. By leveraging the advantages of CFDs and practicing diligent risk management, traders can increase their chances of success in the dynamic world of Forex trading. Whether you’re a novice or an experienced trader, continuous learning and adapting to market trends will be key to your long-term success.

- Насколько самоуверенность воздействует на понимание побед - December 4, 2025

- GameArt Casinos 2025 ⭐ Best GameArt casino Dr Bet Login login Gambling enterprise Bonuses & The Harbors - December 4, 2025

- Online Casino’s in Nederland: Regelgeving en Praktische Vereisten - December 4, 2025