Exploring Forex Trading Prop Firms: A Gateway to Success

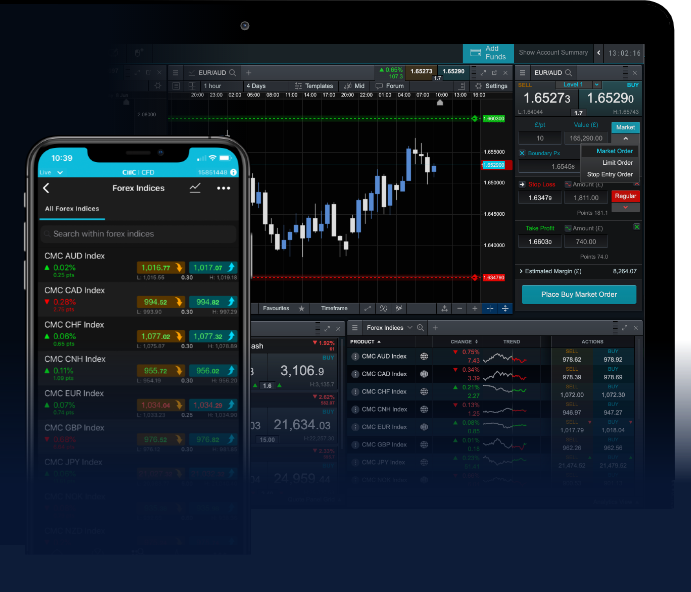

In the dynamic world of Forex trading, prop firms have emerged as a popular option for aspiring traders who wish to leverage capital without exposing personal funds. These proprietary trading firms provide a structured environment that offers not only financial backing but also the necessary tools and education to succeed. forex trading prop firms https://trader-apk.com/

What Is a Prop Firm?

A proprietary trading firm, or prop firm, is a company that uses its own capital to trade in various financial markets, including Forex. Unlike traditional retail trading, where individuals trade their own money, prop firms allow traders to utilize the firm’s capital, thus providing them with the opportunity to take larger positions and potentially earn higher returns.

How Forex Prop Firms Work

Forex prop firms typically operate under a straightforward model: they recruit traders, provide them with training and tools, and allow them to trade on the firm’s behalf. In return, the traders share a portion of their profits with the firm. This model benefits both parties—traders gain access to capital and resources while the firm earns a portion of the profits generated from successful trades.

Key Features of Forex Prop Firms

- Leverage and Capital: Forex prop firms offer various leverage options, allowing traders to take larger positions than they could with their own funds. This means higher potential returns, but also comes with increased risk.

- Training and Support: Many prop firms provide comprehensive training programs that cover trading strategies, risk management, and market analysis. This educational support is invaluable for developing the skills necessary to succeed.

- Performance-Based Compensation: Traders are often rewarded based on their performance, which not only motivates them to excel but also aligns their interests with those of the firm.

- Risk Management: Prop firms usually have stringent risk management rules in place. These rules help to protect both the trader and the firm from excessive losses, ensuring sustainable trading practices.

Advantages of Joining a Forex Prop Firm

There are several compelling reasons for traders to consider joining a prop firm. Here are some of the most notable advantages:

1. Access to Larger Capital

One of the primary benefits of trading with a prop firm is the access to larger amounts of capital. This can allow traders to take larger positions and diversify their strategies, which can lead to greater profit potential.

2. Reduced Financial Risk

Since prop firms provide traders with capital, they can limit their personal financial risk. This is particularly beneficial for beginner traders who may not have the funds to trade effectively on their own.

3. Education and Resources

Many prop firms offer extensive training programs, access to analytics, trading platforms, and educational content. Having these resources at their disposal can significantly improve a trader’s success rate.

4. Networking Opportunities

Joining a prop firm can provide valuable networking opportunities with other traders, mentors, and finance professionals. This can lead to collaborations, shared strategies, and overall growth within the trading community.

Challenges of Forex Prop Trading

While prop trading offers many advantages, it’s not without challenges. It’s essential for prospective traders to be aware of potential pitfalls.

1. Stringent Performance Metrics

Prop firms usually have strict performance requirements. If a trader fails to meet these benchmarks consistently, they may lose access to the firm’s capital and support. This can create pressure to perform and may be stressful for some individuals.

2. Profit Sharing Model

While profit-sharing can be a positive aspect, it also means that traders might only receive a portion of their earnings. This can deter some individuals, especially those who prefer to keep all profits from their trades.

3. Risk Management Constraints

Most prop firms have strict trading rules and risk management policies. While these are designed to protect both the trader and the firm, they may limit individual trading strategies and decision-making.

Choosing the Right Forex Prop Firm

Selecting the right prop firm is crucial for a trader’s success. Here are some factors to consider when evaluating which firm is the best fit:

1. Reputation and Track Record

Research the firm’s history, reputation, and the experiences of other traders. A firm with a strong track record of success and positive feedback from its traders is likely a safe bet.

2. Training Programs

Consider the quality and comprehensiveness of the training programs offered. Good prop firms invest in their traders’ education, enabling them to refine their skills continuously.

3. Fee Structures

Evaluate the fee structures associated with joining and trading through the prop firm. Some firms may charge monthly fees, while others may have a profit-sharing model. Understanding these costs upfront is essential for financial planning.

4. Trading Conditions

Look into the trading conditions provided by the firm, including spreads, commissions, and leveraged options. Favorable trading conditions can enhance profitability and improve the overall trading experience.

Conclusion

Forex trading prop firms present an exciting opportunity for traders of all skill levels to enhance their trading experience. By providing access to capital, education, and a supportive environment, these firms can help aspiring traders excel in the Forex market. However, it’s crucial to weigh both the advantages and challenges inherent to prop trading to make informed decisions. Ultimately, the right prop firm can be a game-changer, paving the way for success in the competitive world of Forex trading.

- Насколько самоуверенность воздействует на понимание побед - December 4, 2025

- GameArt Casinos 2025 ⭐ Best GameArt casino Dr Bet Login login Gambling enterprise Bonuses & The Harbors - December 4, 2025

- Online Casino’s in Nederland: Regelgeving en Praktische Vereisten - December 4, 2025