Effective Forex Swing Trading Strategies for Success

Forex swing trading is a popular approach among traders looking to capitalize on short to medium-term price movements in the foreign exchange market. Unlike day trading, which requires round-the-clock monitoring of the markets, swing trading allows traders to hold positions for several days or even weeks, aiming to profit from price “swings.” This article will delve into some effective forex swing trading strategies that can help you navigate this dynamic market successfully. Additionally, you can explore forex swing trading strategies Pakistani Trading Platforms for more resources.

Understanding Forex Swing Trading

Swing trading is a trading style that focuses on capturing short- to medium-term market moves. Swing traders typically hold onto their positions for several days or weeks, aiming to benefit from an anticipated market move. This trading style is based on the idea that prices move in trends and cycles and that after a trend reaches its peak or trough, a reversal is likely to happen.

The Importance of Technical Analysis

One of the cornerstones of successful swing trading is technical analysis. This involves studying price charts, patterns, and indicators to predict future price movements. Swing traders use various tools to identify potential entry and exit points, including:

- Support and Resistance Levels: These are key price levels where the market tends to reverse or consolidate. Identifying these levels helps traders make informed decisions about when to enter or exit a trade.

- Chart Patterns: Patterns such as head and shoulders, triangles, and double tops/bottoms can indicate potential reversals or continuations of price movements.

- Indicators: Popular indicators like Moving Averages, Relative Strength Index (RSI), and MACD can provide insights into market trends and momentum.

Developing a Swing Trading Strategy

Creating a solid swing trading strategy involves several critical steps. Below are some essential components to consider:

1. Define Your Trading Goals

Before diving into swing trading, it’s important to establish clear goals. Determine your risk tolerance, preferred trade duration, and profit targets. Understanding these aspects will guide your strategy and help you manage your expectations.

2. Choose the Right Currency Pairs

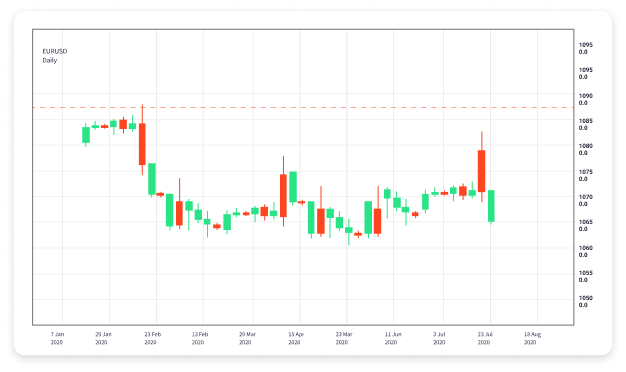

Not all currency pairs are created equal for swing trading. Look for pairs that exhibit volatility, as this increases the potential for profitable trades. Major currency pairs (like EUR/USD, USD/JPY) tend to have higher liquidity and predictable movements, making them ideal for swing trading.

3. Use a Multi-Timeframe Analysis

Employing a multi-timeframe analysis can enhance your swing trading strategy. Start by analyzing longer timeframes (daily, weekly) to identify the overall trend, and then switch to shorter timeframes (4-hour, hourly) to pinpoint entry and exit points. This approach enables you to align your trades with the broader market direction.

4. Risk Management

Effective risk management is crucial for long-term success in swing trading. Consider the following risk management techniques:

- Stop-Loss Orders: Always use stop-loss orders to limit potential losses. Determine the maximum amount you’re willing to lose on a trade and set your stop-loss accordingly.

- Position Sizing: Adjust your position size based on your account balance and risk tolerance. Never risk more than a small percentage of your total capital on a single trade.

- Risk-Reward Ratio: Aim for a favorable risk-reward ratio (e.g., 1:2 or 1:3) to ensure that your potential winnings outweigh your potential losses.

Popular Swing Trading Strategies

Here’s a look at some popular swing trading strategies that traders commonly use to maximize their chances of success:

1. Moving Average Crossovers

Moving average crossover is a simple yet effective strategy that involves using two moving averages: a short-term (e.g., 10-day) and a long-term (e.g., 50-day) moving average. A buy signal is generated when the short-term moving average crosses above the long-term moving average, indicating a potential uptrend. Conversely, a sell signal occurs when the short-term moving average crosses below the long-term moving average.

2. Fibonacci Retracement

Fibonacci retracement levels can help traders identify potential reversal points during a price correction. By plotting key Fibonacci levels (23.6%, 38.2%, 50%, 61.8%, and 100%) on a price chart, traders can anticipate where the price may bounce back or continue its trend. Using these levels alongside other technical indicators can increase the accuracy of entry and exit points.

3. Breakout Trading

Breakout trading involves entering a trade when the price breaks above a significant resistance level or below a key support level. This strategy capitalizes on the momentum that often follows a breakout. Once a breakout occurs, traders may place a buy order just above the breakout point and a sell order just below the breakout point to capture potential profits.

Psychology of Swing Trading

The psychological aspect of trading cannot be overlooked. Swing traders must remain disciplined and patient, waiting for the right setups while avoiding emotional decision-making. Here are some tips to manage trading psychology:

- Stay Disciplined: Stick to your trading plan and strategy. Avoid making impulsive decisions based on emotions or market noise.

- Learn from Losses: Understand that losses are part of trading. Analyze losing trades to identify mistakes and prevent them in the future.

- Maintain a Trading Journal: Keeping a journal of your trades, including your emotions and thought processes, can help improve your trading performance over time.

Conclusion

Forex swing trading can be a rewarding style of trading when approached with the right strategies and mindset. By conducting thorough technical analysis, developing a comprehensive trading plan, and practicing effective risk management, you can increase your chances of success in the forex market. Remember that continuous learning and adaptation to changing market conditions are key components of becoming a successful swing trader. Start by implementing these strategies, and with time and practice, you may find yourself achieving your trading goals.

- Насколько самоуверенность воздействует на понимание побед - December 4, 2025

- GameArt Casinos 2025 ⭐ Best GameArt casino Dr Bet Login login Gambling enterprise Bonuses & The Harbors - December 4, 2025

- Online Casino’s in Nederland: Regelgeving en Praktische Vereisten - December 4, 2025